Welcome to the finance update for the week ending 18 November, 2023.

Whilst the Big 4 banks are yet to pass on the interest rate increases as a result of last week’s RBA announcement – that will all land next week – many of the smaller lenders have already done so as illustrated in our interest rate table below.

Interestingly, after years of domination and growth, CBA’s market share of loans submitted via brokers continues to fall which could be great news for borrowers. If they want to reverse the trend, they’ll need to lower their interest rates – which could trigger a price war with others following in their footsteps.

In this week’s newsletter, we take a look at channel conflict in the world of finance off the back of news earlier in the week about CBA being up to some of their old tricks again.

- Channel Conflict

WHAT IS CHANNEL CONFLICT?

Channel conflict occurs in the broking industry when different distribution channels, lenders and brokers in this case, clash or compete for the same customers.

It pops its head up occasionally and obviously puts brokers at somewhat of a disadvantage.

HOW DOES IT PLAY OUT?

Instinctively you’d think that channel conflict would manifest itself in the form of more favourable interest rates when dealing with a lender directly than via a broker, however that generally isn’t the case, it’s much more subtle than that.

Instead, it typically centres around the processing time of loan applications, meaning, loan applications submitted directly to the lender get assessed sooner and therefore quicker than loans submitted to the same lender via a broker.

WHY DO THEY DO IT?

Lenders deny this kind of behaviour, of course, but it does happen. The simple fact is that loans submitted directly (i.e bypassing a broker) allow the lender to retain greater margin . As you’d be aware, lenders pay brokers a commission on settled loans so by cutting out the broker, they don’t have to pay a commission.

So it stands to reason that some lenders may encourage borrowers to deal with them directly, and the promise of faster processing times is a hook to achieve that end.

IS IT GOOD FOR BORROWERS?

On the one hand, yes, but on the other hand not so much.

Sure it’s nice to get a decision sooner, however unlike brokers, lenders are not bound by Best Interests Duty which is an ASIC obligation imparted upon brokers designed to ensure that clients receive advice that meets their objectives, financial situation and needs, and that brokers act in the best interests of clients when providing advice.

In simple terms, brokers need to demonstrate that they have found the most suitable loan for clients however lenders do not have the same obligation.

I guess the answer to the question can best be answered with another question – would you prefer to save a day or so dealing with a lender directly who has their best interests front and centre, or a broker who has your bests interests front and centre?

- Interest Rates

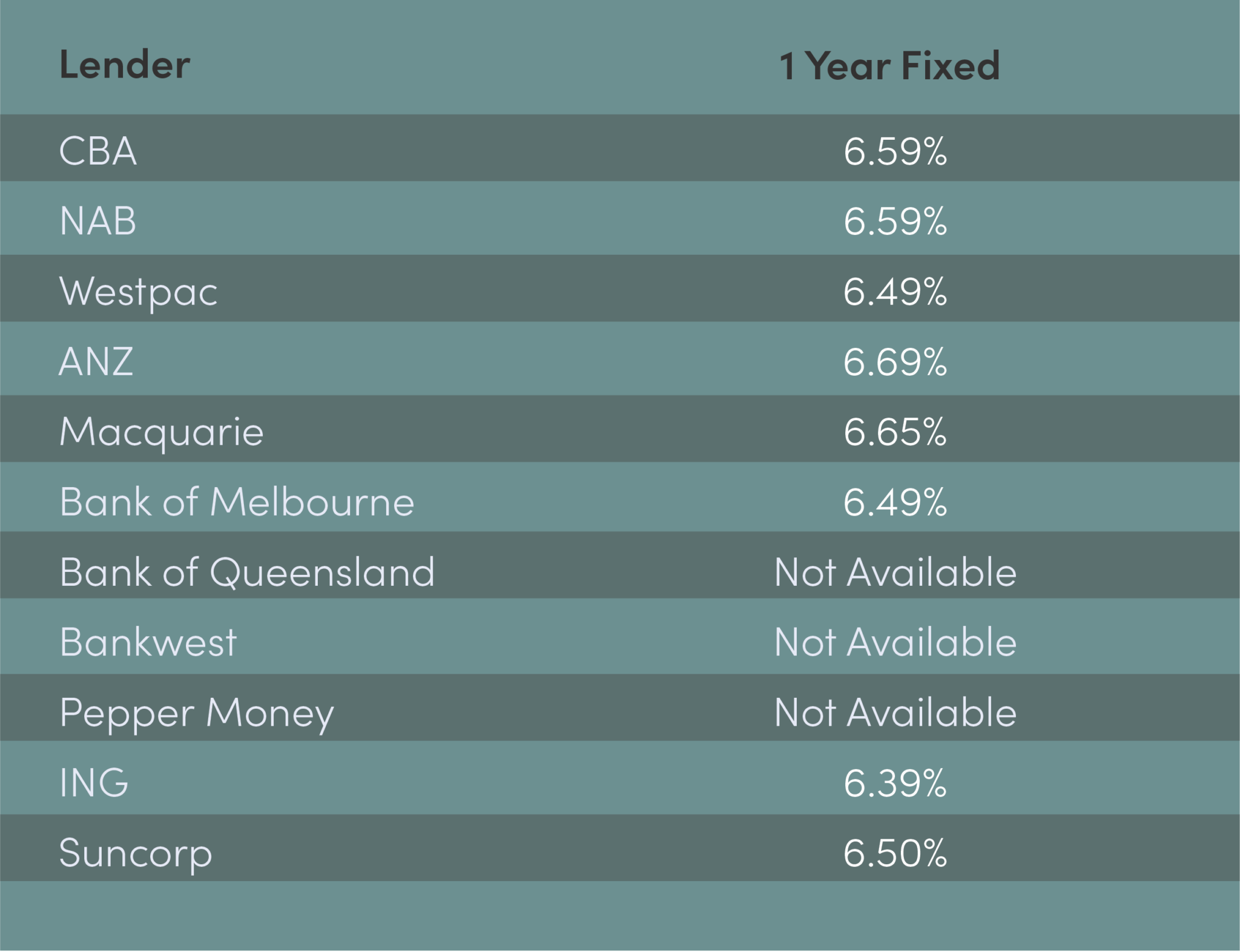

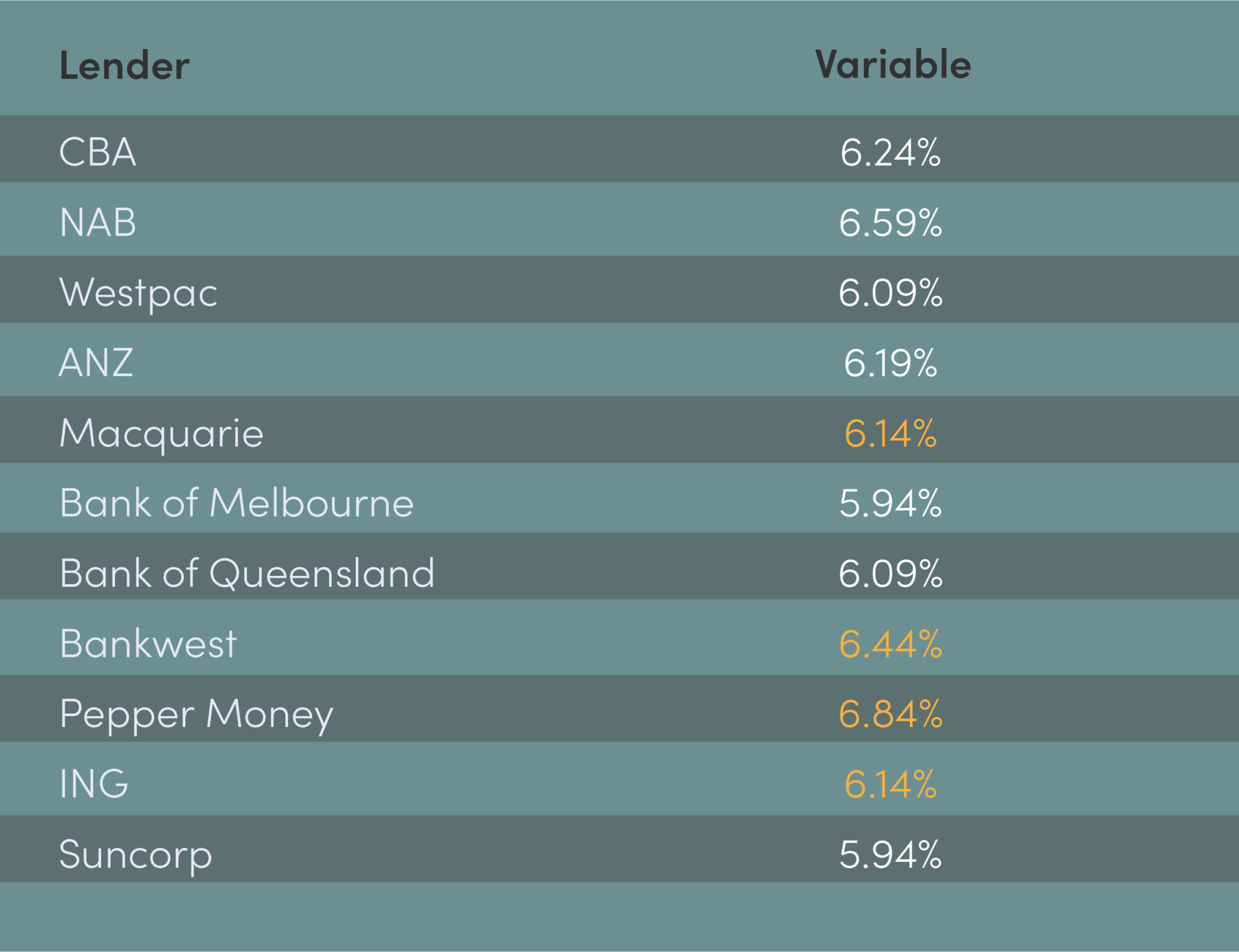

Any changes in interest rates from last week are highlighted in orange.

Note – Increases announced by lenders as a result of RBA decisions normally take 1-2 weeks to come into affect.

VARIABLE

1 YEAR FIXED